The automotive sector’s resilience remains noteworthy when compared to other metal industries, despite the Monthly Metal Index’s (MMI) lateral movement over the past seven months.

While pent-up consumer demand continues to buoy the industry, challenges like high interest rates and plummeting steel prices due to weakened demand persist.

The question arises: Could the current decline in steel prices potentially spur the auto industry forward?

A notable prospect on the horizon is the Federal Reserve’s role in shaping this landscape. The long-term trajectory could experience an upswing if the Fed opts to lower interest rates.

However, experts predominantly predict such a shift to occur no earlier than 2024. Until a dovish approach is adopted by the Fed, the MMI could remain relatively static, as evidenced by its incremental rise of 2.31%.

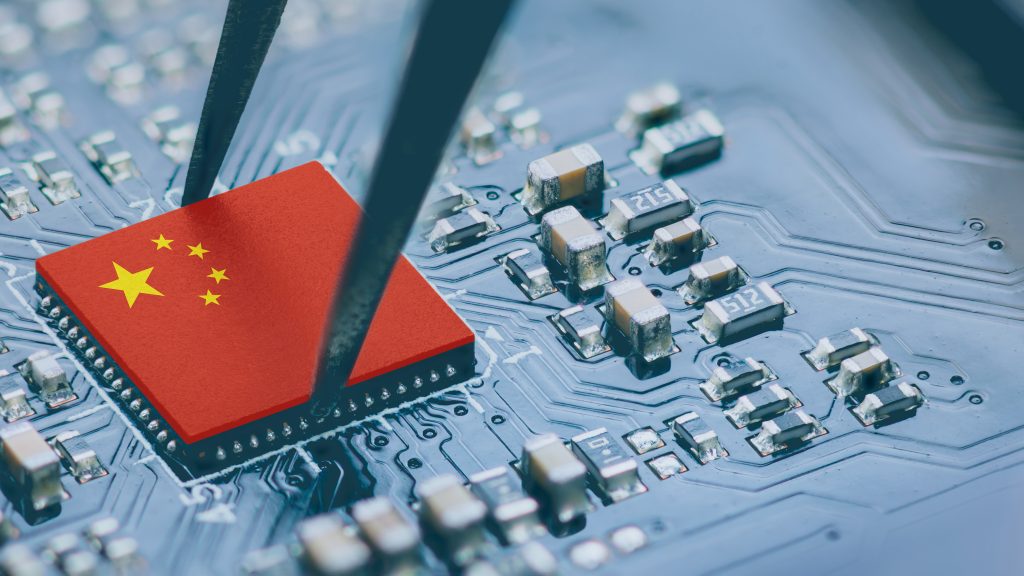

Amidst this, the automotive industry confronts the persistent semiconductor shortage, which exerts a significant toll on various sectors, particularly electric vehicle (EV) production.

This shortage has resulted in shortened production schedules and substantial financial losses for automakers, with projections indicating a staggering reduction of 2.8 million global vehicles in 2023 due to the scarcity.

The Impact of Chip Scarcity on the Automotive Landscape

As the semiconductor shortage grips the automobile sector, particularly the realm of electric vehicle (EV) production, manufacturers grapple with truncated production schedules and considerable financial setbacks.

This crisis looms with seriousness, with an estimated 2.8 million global vehicles poised to be affected in 2023.

This staggering statistic underscores the severity of the situation, highlighting the extent to which the semiconductor shortage has disrupted industries, with automakers being significantly impacted.

While consumer electronics manufacturers account for a considerable portion of microchip supply (approximately 50%), automakers command roughly 15% of the supply.

As vehicles grow increasingly technologically advanced, their reliance on microchips intensifies, underscoring the significance of this component scarcity.

The Road Ahead for the EV Market

Despite the global semiconductor crisis, an interesting trend emerges, as manufacturers consider price cuts to qualify for EV tax credits, potentially rendering electric vehicles more affordable.

However, consumers may need to exercise patience as they await more budget-friendly options.

Due to the persistent chip shortage, automakers are projected to eliminate around 18 million vehicles from their production plans by the end of 2023.

Although the chip supply situation is showing signs of improvement, challenges and volatility may still persist.

Steel Prices and Their Impact on the Auto Sector

Presently, steel prices appear to be meandering in a sideways pattern, with recent fluctuations indicating a potential shift.

This lateral steel price movement could offer advantages to the automotive sector in various ways:

Enhanced Predictability: Stability in steel prices provides automakers with more predictable and consistent cost projections for steel inputs.

This stability facilitates streamlined planning, budgeting, and operational decision-making.

Competitive Pricing: Steady steel prices enable automakers to offer competitive vehicle pricing.

When steel prices are volatile or increasing, automakers might be compelled to pass on elevated costs to consumers, resulting in higher vehicle prices.

Conversely, stable steel prices allow automakers to maintain affordable pricing, appealing to a wider consumer base.

Sustained Supply: Stable steel prices ensure a continuous supply of steel for the automotive sector.

Predictable prices empower automakers to secure a consistent flow of steel, vital for sustained manufacturing operations.

However, the automotive industry remains susceptible to the negative implications of substantial or sudden steel price shifts:

Profit Margins: A significant change in steel prices, whether an increase or decrease, can directly impact automakers’ costs and subsequently eat into profit margins.

Production Costs: Swift fluctuations in steel prices may lead to higher production costs for automakers, potentially leading to reduced profit margins.

This scenario could become particularly challenging if steel costs surge while other expenses remain steady.

Consumer Affordability: Escalating steel prices might prompt automakers to pass on the additional expenses to customers through higher vehicle prices.

This could result in decreased affordability and diminished demand for new vehicles.

The complexity of the steel price impact on the automotive industry’s profitability and pricing strategies cannot be overlooked.

The extent of these implications varies based on factors like the magnitude of steel price swings, market dynamics, and individual automakers’ tactics to mitigate these challenges.

In summary, the automotive industry stands at a crossroads influenced by multifaceted factors.

While the sector demonstrates resilience amidst challenges, the interplay of steel prices and the ongoing semiconductor shortage remains pivotal in shaping its trajectory.

The automotive landscape’s potential evolution relies on the delicate equilibrium between steel price stability, consumer demand, and the industry’s capacity to navigate volatile market conditions.

Source : oilprice.com